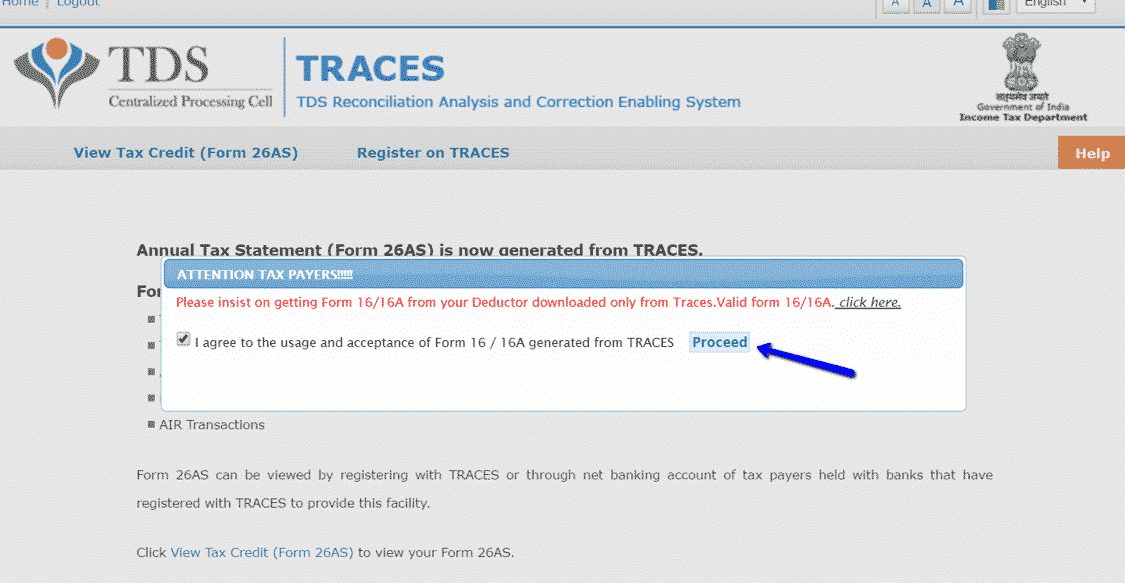

Hence, once the required details have been entered, click on “Validate” If the TDS certificate received by you is valid, then the website will show the same result. Enter the following details in their respective fields: – TAN of Deductor – TDS Certificate Number – Assessment Year – Source of Income – TDS Amount Deducted as per the Certificate (INR) Thus, we move to the verification page of the TDS Certificate. Select the “ Verify TDS Certificate” Optionįrom the “ View/Verify Tax Credit” drop-down list on the dashboard select the “Verify TDS Certificate” option.Navigate to the “My Account” drop-down list on the dashboard and select the “View Form 26AS” Option.Ĭlick on the “Confirm” to move to the TRACES portal.Īgree to the terms by clicking on the check-box and click on the “ Proceed” option when the pop-up appears. Visit the incometaxefiling to Login to your Account Deductee claims the TDS credit while filing the Income Tax Return.Deductor issues a TDS Certificate to the Deductee ( Form 16, Form 16A, Form 16B, Form 16C, Form 16D).Hence, the deductor files the relevant TDS Return Form ( 24Q, 26Q, 27Q, 27EQ).Therefore, deductor deposits the TDS with the Income Tax Department.The deductor makes the payment to the Deductee after deducting TDS under relevant section ( 194C, 194J, 194H, 194IA, 194I, 194A, 192, 194IB).It is important to understand how this entire process works. While a Deductor can download TDS Certificate from TRACES, the Deductee can verify the details of the TDS Certificate from TRACES. An individual receives 4 types of TDS certificates in a financial year. Hence, it is important to verify the validity of the TDS certificate.

This certificate is usually called the TDS certificate. Every person deducting tax at source is required as per Section 203 to furnish a certificate to the payee to the effect that tax has been deducted along with certain other particulars.

0 kommentar(er)

0 kommentar(er)